A new “gang of five” warrant airlines’ ongoing scrutiny in terms of distribution as presented by Henry Harteveldt, co-founder of Atmosphere Research Group, a respected travel industry think tank , in its report The Future of Airline Distribution – A Look Ahead to 2017. These five companies are: Concur, parent of the TripIt itinerary management tool, Apple, Facebook, Google, and Amazon — CAFGA for short. Obviously none of the five are traditional airline distribution players.

The study presents the following observations leading to the inevitable shift in distributions:

- The digital traveller is now in control and want more.

“The world in 2012 is a digital one. More than one billion people have Facebook accounts. There are more than 200 million tweets per day on Twitter. Apple sold 2 million iPhone 5 smartphones in the first 24 hours the devices were available to pre-order. Every day, more iPhones are sold worldwide than babies are born.” The world’s airline passengers are online citizens, empowered through their extensive adoption of various consumer technology devices. Passengers show strong interest in using mobile devices to plan and book flights, illustrating their comfort with these devices, Atmosphere’s analysis says. “Airline executives expect mobile to generate 7 percent of online direct sales in 2012. By 2017, Atmosphere expects 50 percent of online direct bookings will be made on mobile devices – with even more ancillary purchases made through mobile, given the devices’ portability and ease of use.” With the increasing online and mobile sales, and the airline distribution system has to serve this demand.

- Future Generations Of Passengers Are Very Different Consumers

Atmosphere says “As the world’s airlines evaluate their distribution strategies, it’s essential to understand the mindset of your future base of customers, especially passengers between the ages of 22 and 35, or Generation Y (“Gen Y”).” Passengers in this age group are more likely to have completed their university studies and entered the workforce, which helps provide them with the disposable income they need to travel. This is a sizable audience and the study says Gen Y passengers have a lifetime of buying airline tickets ahead of them. They will eventually become more important than Boomers, as Boomers begin to retire and travel less. ” Gen Y passengers are the first to have grown up with the Internet integrated into the daily fabric of their lives. They enjoyed high-speed connectivity at home and school. Their use of laptop computers and mobile phones, rather than desktops, helped them develop a perspective that Internet access is immediate, easy, and omnipresent. Some in this group were the first to use smartphones as young adults. Airline distribution and eCommerce strategies will have to have “mobile first” strategies to be visible to this audience.”

- Distribution Costs Frustrate Airlines

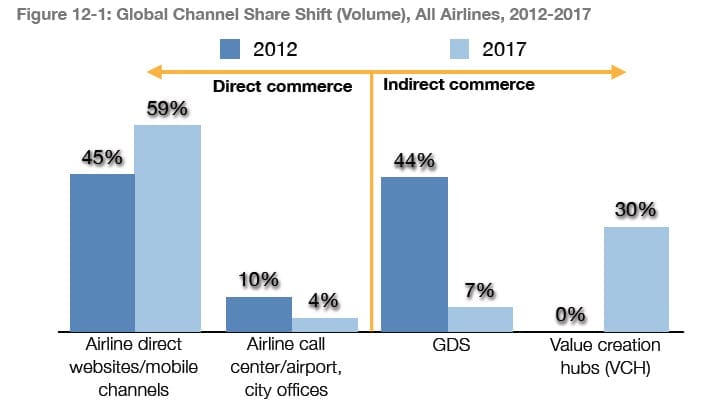

The study finds that airlines have been increasingly successful generating direct sales via their websites and mobile applications — their lowest cost sales channels. The cost of third-party distribution like GDSs frustrates airline executives

- Airlines want not just merchandising the product but also its value

Atmosphere states that airlines want, and expect, their distribution partners to offer passengers helpful contextual information to make well-informed purchase decisions, reducing the number of reservations made based primarily or exclusively on price.

- Evolving Business Strategies

The study further observes that along with changing technology and consumer behavior, the evolution of airline distribution will be heavily influenced by the two largest groups of carriers: global airline alliances and LCCs. ” Established airlines expand, contract, consolidate, and close down. New entrants emerge. Carriers enter and leave routes and markets. New business models and strategies illustrate that innovation is alive within the industry.” Global alliances now engage with LCCs in seeking out new opportunities and relationships, even beyond boundaries.

- The Changing Technology Landscape

As Cloud Computing, mobile and tablet computing, and “Big Data” have entered the landscape, pace of change is truly accelerated.

The study however states that the airline commerce will not ignore its legacy as it re-envisions its purpose. ” It will, however, look to businesses outside the airline industry for inspiration and ideas. For example, search engines know what their users search for and view, their location, and the platform they use (e.g., traditional web, smartphone, tablet). Amazon knows its customers’ addresses, transaction histories, the items they view and buy, forms of payment used, and more. Social networks let people share ideas, information, and opinions. Travellers will expect the same degree of flexibility, responsiveness, and control when they plan, shop, and book their flights. Knowing this, airline commerce teams must work to incorporate experiential elements in their commerce platforms — including those belonging to third-parties — so they can effectively deliver the selling experiences passengers expect.”

This evolving distribution channels will stem up new business models and systems that are interrelated such as:

- Shifting from the Global Distribution System concept to the Value Creation Hubs (VCH). The report however notes that this doesn’t mean the GDSs will go, in fact it is the three major GDSs that have spearheaded the adoption of the Big Data concept.

- Entrance of other content agregators that can help realize the VCH concept, thereby creating another player in the industry.

- New rules, probably a lot of changes and innovations with the BSP systems.

And why should airline executives pay attention to these companies to CAFGA? The report has this to say:

- • Concur may know more about your travellers‘ trips than you. TripIt by Concur lets travelers upload their flight, hotel, and other travel reservations to a consolidated itinerary. As a result, TripIt can create a “super PNR” of its users’ trips, and Concur can integrate user data into a comprehensive data warehouse. Concur sits on massive volumes of customer data and insights. Atmosphere believes Concur will leverage this by selling data to airlines — data that may include insights such as market share, fare paid, purchase channels used, and more — and through TripIt-based marketing solutions.

- • Apple’s Passbook may be a wolf in sheep’s clothing. Passbook,Apple’s new mobile wallet, can store a traveller’s loyalty program account information,boarding passes, coupons, and more. Atmosphere sees Passbook as Apple’s “Trojan Horse” into the travel space. Apple won’t be a travel retailer, since travel doesn’t offer the same margins as entertainment, and selling travel brings with it customer service burdens. Instead, Atmosphere believes that Apple will use Passbook as the media and financial “toll booth” that airlines will have to pay to reach their passengers.

- • Facebook knows how your passengers live their lives. With more than one billion users worldwide, Facebook has become the global “town square.” Atmosphere believes Facebook will attempt to aggressively monetize its users by using real-time bidding (RTB) algorithms that will pit airlines against intermediaries to reach travellers. If there’s an upside to Facebook, it’s the site’s promise of strong consumer targeting capabilities.

- • Google will do everything but fly your aircraft. Whether it’s to dream about, plan,shop for, book, or manage a trip, Google participates in almost every aspect of airline distribution, eCommerce, and marketing. Google’s Chrome web browser is the world’s most-used.30 Google has the top general search engine. It offers metasearch, through Google Flight Search. It owns ITA Software, which sells airline pricing and reservations software. Google offers several social media platforms, including Google+, Picasa, and YouTube. Google markets its own laptop computers, smartphones and tablet devices, created the Android mobile operating system, and operates the Google “Play Store,” where users can download mobile apps. Google’s mobile wallet can help travellers pay for their purchases. Google Maps and Google Earth can help travelers plan and navigate through their destination — including airports. “Google Goggles” will serve as navigational devices, with lenses that present geolocation-based information and offers to their users. Google offers many excellent technology products, and it is a genuinely creative business. Google can use its power and reach to facilitate or interfere with the relationship an airline and passenger have with one another. Even if it chooses to facilitate the relationship, Google can make that access extremely expensive, or force an airline to use a certain product if the airline wants to reach to passengers through a specific channel.

- • Amazon is the world’s retail marketplace. Amazon’s global websites, with their extensive offerings and “one click” buying, define the consumer digital commerce experience. Amazon may not sell travel directly, but its Amazon Web Services division hosts various transactional websites. While market share of its Kindle tablets may be small compared to Apple’s iPad and devices that run the Android operating system, Amazon gains a commerce short-cut to Kindle users’ wallets through the devices’ integration with its digital stores. And, like Google and Apple, Amazon is entering the mobile wallet space. Amazon is a powerful, mighty retailing hub, and is positioning itself to be a factor in how airlines sell, and how passengers buy, air travel.

For small travel trade business owners, this is a good opportunity. The distribution concept is coming to another arena which we are all familiar with – the internet. So let’s just get on, be more social, explore and strategize on how are we going to fit in with these new business models.